Place Lay Formula. Zero Risk Trader. Smart Racing Trader. Pro Betfair trader. Retirement Staking Plan. Royal Routine System. Avalanche Staking Plan. Profit Multiplier. Lay Cover Staking. Nunes v Anderson betting odds and predictions. Here's a simple horse betting formula we created. A = the finish position of a horse in its last race. B = the number of times the horse has finished worse than third in its last six races. C = the numeric value given to the horses's chances today, with the lowest number being the best bet. Betting Profits Formula. For the past couple of weeks, I have been bombarded with emails about some bloke called Joshua Jacobs, every one of my many email addresses were filling up with the usual hard sales bull that appears in your inbox all too frequently.

To be successful at matched betting, you either need to know your maths formulas, or use software like OddsMatcher that makes those calculations for you. If you want to work out your odds, profit and optimum stake yourself, below are the matched betting formulas you need. You can also let our matched betting calculator do some of the hard sums for you.

We also have a free matched betting spreadsheet, although it's much easier to use our Profit Tracker tool!

Qualifying bet and welcome bet formulas

- a) Profit if back bet wins:

Profit = back stake * (back bet odds – 1) – lay stake * (lay bet odds – 1) - b) Profit if lay bet wins:

Profit = lay stake * (1 – commission) – back stake - c) To work out the ideal stake for even profit, no matter what the result:

Lay stake = back odds * back stake / (lay odds – commission) - d) Final profit for the qualifying bet and welcome bet stage:

Final profit = lay stake * (1 – commission) – back stake

Free bet – stake NOT returned (SNR) formulas

- a) Profit if the free bet SNR wins:

Profit = (back odds – 1) * free bet size – (lay odds – 1) * lay stake - b) Profit if the lay bet wins:

Profit = lay stake * (1 – commission) - c) To work out the ideal lay stake for the same profit, no matter what the result:

Lay stake for an even profit = (back odds – 1) / (lay odds – commission) * free bet size - d) Final profit for the free bet (SNR) stage:

Final profit = lay stake * (1 – commission)

Free bet – stake returned (SR) formulas

- a) Profit if free bet wins:

Profit = free bet value * back odds – lay stake * (lay odds – 1) - b) Profit if lay bet wins:

Profit = (1 – commission) * lay stake - c) To work out the ideal lay stake for even profit, no matter what the result:

Lay stake for an even profit = (back odds * free bet value) / (lay odds – commission) - d) Final profit for the free bet (SR) stage:

Final profit = (1 – commission) * lay stake

While this article includes all the matched betting maths formulas you need to work everything out without any outside help, software like OddsMatcher ensures you don't have to worry about making complex calculations. We also have a matched betting forum, where you can go to ask for advice from other members and swap your success stories.

An arb arises when betting companies take an alternative view on the outcomes of a particular sporting event, meaning that they offer different odds to reflect the probabilities. Should you find a situation where bookies disagree by a large enough variance, you could lock in profit regardless of which outcome win.

Because of how a bookie sets their prices, you are guaranteed to lose money if you bet on each outcome within an event at the same bookmaker. For example, backing the favourite to win, underdog to win and the draw in a football match would ensure the bookie rubs their hands with glee as they take your hard-earned cash. This is because the betting company includes an overround in their pricing which gives them an edge as it replaces the true odds of each outcome with their own odds (You can read more about probabilities, odds and overrounds here.

However, comparing the odds for the same sporting event from different betting companies can open up an opportunity because the bookies have an alternative view, or may have made an error. This doesn't mean that a favourite with one bookie becomes the underdog at another, more that there will be a slight difference in the odds that are on offer.

For example, BetVictor could price a Floyd Mayweather Jr win at decimal odds of 1.48 (67.6% implied probability) whereas 888Sport could think he's even more likely to win and offer odds of 1.36 (73.5% implied probability). As a result, the price on his opponent would also change between the two bookies and mean that backing the underdog could see a range between 2.75 (36.4% probability) and 3.25 (30.8% probability). If the numbers add up correctly, you could find that backing Mayweather with BetVictor and his opponent with 888Sport could automatically put you into the green no matter who won the bout.

As shown in this boxing example, generally there is only a slight difference between the prices set by bookmakers. This means that you need to bet with high stakes in order to make any serious money as arbitrage bets typically range between 1% and 10% profit. This could mean that a £1,000 stake would return as little as £10 and as much as £100 which may not be worth the vast amounts of time taken to identify the surebet in the first place. Although the likes of online bookies and odds comparison sites have helped the punter identify arbitrage opportunities, it also means that the bookmakers themselves can use them to spot pricing mistakes or identify if there odds are drastically different. This means that the opportunity for arbing is less than it once was.

Software and bots do exist which identify arbitrage opportunities, however I've personally never used them so couldn't comment on their effectiveness. Instead, we're going to look at how to find arbitrage bets using a manual process, which is actually relatively simple to do, it can just be time consuming. The process is as follows:

1. Using an odds comparison site such as Oddschecker, find a sporting event which offers two outcomes.

2. Find the highest odds available for each outcome from two different bookmakers.

3. Calculate whether the odds represent an arbitrage betting opportunity.

4. If so, calculate the individual stakes you need to bet with at each bookmaker.

5. Place each of the bets.

To explain this process further, let's look at a real-life example of a surebet based on the step-by-step approach above. As context, I went to Oddschecker, and after a little while of searching, came across the ATP Indian Wells tennis tournament which had Andy Murray (1.18 highest with Boylesports) as the favourite to win the match against Vasek Pospisil (7.00 highest with SkyBet). Why did this match grab my interest? Well, let me share the below table which gives an indication of the odds you're looking for to potentially identify a surebet.

| Outcome 1 | Outcome 2 |

|---|---|

| 1.1 | 11.0 |

| 1.2 | 6.0 |

| 1.3 | 4.33 |

| 1.4 | 3.5 |

| 1.5 | 3.0 |

| 1.6 | 2.67 |

| 1.7 | 2.43 |

| 1.8 | 2.25 |

| 1.9 | 2.11 |

| 2.0 | 2.0 |

After noticing that 1.18 and 7.00 looked like a potential arbitrage bet by looking at 1.20 and 6.00 above, the next step is to calculate whether the odds actually represent a surebet. Luckily, there are plenty of online calculators available which do all of the hard work for you. However, we can take a look at the actual calculations to see how things work behind the calculator.

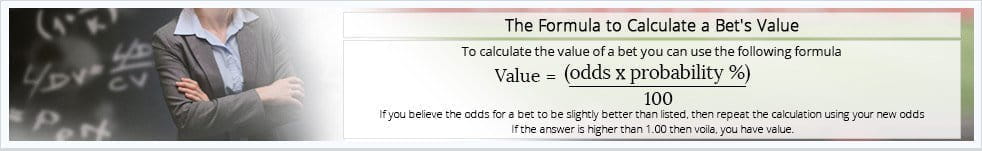

Firstly, if not using an online calculator, you need to work out the arbitrage percentage which identifies whether you have a surebet. As mentioned above, with an individual bookmaker, the total percentage of all outcomes in a sporting bet will add up to greater than 100% due to the overround. Therefore, we are looking for opportunities where all outcomes from different bookies add up to less than 100% as this suggest that the bookies have different opinions on the outcomes. To calculate the arbitrage percentage, you can use the following formula:

Arbitrage % = ((1 / decimal odds for outcome A) x 100) + ((1 / decimal odds for outcome B) x 100)

Andy Murray Win: (1 / 1.18) x 100 = 84.746%

Vasek Pospisil Win: (1 / 7.00) x 100 = 14.286%

84.75% + 14.29% = 99.032% (less than 100%, therefore an arbitrage bet)

Having found a surebet, we then need to calculate the profit we will receive based on the amount of money we are willing to invest. If, for example, you are wanting to place £500 stake on the tennis surebet above, you would calculate the profit using the following formula:

Profit = (Investment / Arbitrage %) – Investment

(£500 / 99.032%) – £500 = £4.89 profit (from £500 stake)

The next step is to calculate how your investment needs to be broken down in terms of stakes across both bets. This is so that you are returning the same profit regardless of which outcome wins. The idea is to return the same profit regardless of whether the first or second outcome is successful, so it is critical to use the correct stakes – if not, you could find that one outcome is more profitable than the other or that you actually lose money if one outcome wins. To calculate the individual stakes:

Individual bets = (Investment x Individual Arbitrage %) / Total Arbitrage %

Andy Murray Stake = (£500 x 84.746%) / 99.032% = £427.87

Vasek Pospisil Stake = (£500 x 14.286%) / 99.032% = £72.13

Arbitrage Betting Formula

£427.87 + £72.13 = £500 total stake

You therefore know that to make £4.89 profit from £500 (0.968% profit) you need to place a bet of £427.87 on Andy Murray to win at odds of 1.18 and £72.13 on Vasek Pospisil to win at odds of 7.00. As you can see, this is quite a lot of work for less than £5.00 profit, but as mentioned, online calculators can take a lot of the manual work away from this process.

Arbitrage betting – also known as arbs, surebets, miraclebets and surewins – is a technique in which you place bets with different online betting companies in order to cover all of the outcomes of a sporting event to guarantee yourself profit.

An arb arises when betting companies take an alternative view on the outcomes of a particular sporting event, meaning that they offer different odds to reflect the probabilities. Should you find a situation where bookies disagree by a large enough variance, you could lock in profit regardless of which outcome win.

Because of how a bookie sets their prices, you are guaranteed to lose money if you bet on each outcome within an event at the same bookmaker. For example, backing the favourite to win, underdog to win and the draw in a football match would ensure the bookie rubs their hands with glee as they take your hard-earned cash. This is because the betting company includes an overround in their pricing which gives them an edge as it replaces the true odds of each outcome with their own odds (You can read more about probabilities, odds and overrounds here.

However, comparing the odds for the same sporting event from different betting companies can open up an opportunity because the bookies have an alternative view, or may have made an error. This doesn't mean that a favourite with one bookie becomes the underdog at another, more that there will be a slight difference in the odds that are on offer.

For example, BetVictor could price a Floyd Mayweather Jr win at decimal odds of 1.48 (67.6% implied probability) whereas 888Sport could think he's even more likely to win and offer odds of 1.36 (73.5% implied probability). As a result, the price on his opponent would also change between the two bookies and mean that backing the underdog could see a range between 2.75 (36.4% probability) and 3.25 (30.8% probability). If the numbers add up correctly, you could find that backing Mayweather with BetVictor and his opponent with 888Sport could automatically put you into the green no matter who won the bout.

As shown in this boxing example, generally there is only a slight difference between the prices set by bookmakers. This means that you need to bet with high stakes in order to make any serious money as arbitrage bets typically range between 1% and 10% profit. This could mean that a £1,000 stake would return as little as £10 and as much as £100 which may not be worth the vast amounts of time taken to identify the surebet in the first place. Although the likes of online bookies and odds comparison sites have helped the punter identify arbitrage opportunities, it also means that the bookmakers themselves can use them to spot pricing mistakes or identify if there odds are drastically different. This means that the opportunity for arbing is less than it once was.

Software and bots do exist which identify arbitrage opportunities, however I've personally never used them so couldn't comment on their effectiveness. Instead, we're going to look at how to find arbitrage bets using a manual process, which is actually relatively simple to do, it can just be time consuming. The process is as follows:

1. Using an odds comparison site such as Oddschecker, find a sporting event which offers two outcomes.

2. Find the highest odds available for each outcome from two different bookmakers.

3. Calculate whether the odds represent an arbitrage betting opportunity.

4. If so, calculate the individual stakes you need to bet with at each bookmaker.

5. Place each of the bets.

To explain this process further, let's look at a real-life example of a surebet based on the step-by-step approach above. As context, I went to Oddschecker, and after a little while of searching, came across the ATP Indian Wells tennis tournament which had Andy Murray (1.18 highest with Boylesports) as the favourite to win the match against Vasek Pospisil (7.00 highest with SkyBet). Why did this match grab my interest? Well, let me share the below table which gives an indication of the odds you're looking for to potentially identify a surebet.

| Outcome 1 | Outcome 2 |

|---|---|

| 1.1 | 11.0 |

| 1.2 | 6.0 |

| 1.3 | 4.33 |

| 1.4 | 3.5 |

| 1.5 | 3.0 |

| 1.6 | 2.67 |

| 1.7 | 2.43 |

| 1.8 | 2.25 |

| 1.9 | 2.11 |

| 2.0 | 2.0 |

After noticing that 1.18 and 7.00 looked like a potential arbitrage bet by looking at 1.20 and 6.00 above, the next step is to calculate whether the odds actually represent a surebet. Luckily, there are plenty of online calculators available which do all of the hard work for you. However, we can take a look at the actual calculations to see how things work behind the calculator.

Firstly, if not using an online calculator, you need to work out the arbitrage percentage which identifies whether you have a surebet. As mentioned above, with an individual bookmaker, the total percentage of all outcomes in a sporting bet will add up to greater than 100% due to the overround. Therefore, we are looking for opportunities where all outcomes from different bookies add up to less than 100% as this suggest that the bookies have different opinions on the outcomes. To calculate the arbitrage percentage, you can use the following formula:

Arbitrage % = ((1 / decimal odds for outcome A) x 100) + ((1 / decimal odds for outcome B) x 100)

Andy Murray Win: (1 / 1.18) x 100 = 84.746%

Vasek Pospisil Win: (1 / 7.00) x 100 = 14.286%

84.75% + 14.29% = 99.032% (less than 100%, therefore an arbitrage bet)

Having found a surebet, we then need to calculate the profit we will receive based on the amount of money we are willing to invest. If, for example, you are wanting to place £500 stake on the tennis surebet above, you would calculate the profit using the following formula:

Profit = (Investment / Arbitrage %) – Investment

(£500 / 99.032%) – £500 = £4.89 profit (from £500 stake)

The next step is to calculate how your investment needs to be broken down in terms of stakes across both bets. This is so that you are returning the same profit regardless of which outcome wins. The idea is to return the same profit regardless of whether the first or second outcome is successful, so it is critical to use the correct stakes – if not, you could find that one outcome is more profitable than the other or that you actually lose money if one outcome wins. To calculate the individual stakes:

Individual bets = (Investment x Individual Arbitrage %) / Total Arbitrage %

Andy Murray Stake = (£500 x 84.746%) / 99.032% = £427.87

Vasek Pospisil Stake = (£500 x 14.286%) / 99.032% = £72.13

Arbitrage Betting Formula

£427.87 + £72.13 = £500 total stake

You therefore know that to make £4.89 profit from £500 (0.968% profit) you need to place a bet of £427.87 on Andy Murray to win at odds of 1.18 and £72.13 on Vasek Pospisil to win at odds of 7.00. As you can see, this is quite a lot of work for less than £5.00 profit, but as mentioned, online calculators can take a lot of the manual work away from this process.

As an aside, it is also worthwhile knowing how to calculate the stake for outcome B if you know how much you plan to bet on outcome A. Rather than the above approach where we split the total stake (£500) into two bets to guarantee the same profit, we can work out how much to place on outcome B if we have bet £500 just on outcome A. This can be done using the following formula:

Stake for outcome B = Stake for outcome A x (Odds for outcome A / Odds for outcome B)

£500 x (1.18 / 7.00) = £84.29 stake for outcome B

To work out total profit, you would then use the above figures in the following calculations:

Profit if outcome A wins: (stake for outcome A x odds for outcome A) – (total investment)

Profit if outcome B wins: (stake for outcome B x odds for outcome B) – (total investment)

If Murray wins: (£500 x 1.18) – (£500 + £84.29) = £5.71

Bovada epl lines. If Pospisil wins: (£84.29 x 7.00) – (£84.29 + £500) = £5.74

Betting Profits Formula Definition

So, by investing £584.29 in this match, you would make a profit of £5.71 if Murray wins or £5.74 if Pospisil wins.

As described above, we've talked about finding surebets by looking at online bookmakers and odds comparison sites to identify the best prices for each outcome in a sporting event. This isn't the only arbing opportunity though – it is also possible to do this via betting exchanges and in betting shops. For instance, you could use the likes of Betfair to back and lay a bet to create a guaranteed profit – along similar lines to trading in the financial markets – although an extra considerations is that you need to factor in the commission for using the service. Similarly, there is also the practice of ‘sharbing' where you are able to create an arbitrage opportunity by using an online bookie for one outcome and a betting shop for the second as shops are usually slower to respond to price changes than online bookies.

Although arbing is not illegal per se, it is viewed very negatively by bookmakers and can often result in bets being cancelled should it be detected. This can have a knock on effect if a bet on outcome A is cancelled with bookie A, but outcome B is not cancelled with bookie B, meaning that you could be seriously out of pocket considering the large stakes at play. Going one step further, it is also not uncommon for betting accounts to be suspended if people are suspected of using surebets. Therefore, heed a word of caution when approaching arbitrage betting despite the promised guaranteed profit on offer.